Expense report management is one of companies’ most sensitive and tricky tasks, especially for large projects.

The expense report is a core document that accounts for costs incurred by an employee during a trip or as part of a specific project.

Managing it can be challenging due to the variety of expenses involved and the complexity of the reporting process.

Let’s take a look at how to manage the expense report in complex projects.

CONTENT

The perfect expense report

Expense report management is critical for many companies, and having a clear and comprehensive expense report is fundamental to ensuring accurate and timely reporting.

A “perfect” expense report should be transparent, detailed and comply with current regulations.

The current regulation on expense reports in Italy is Ministerial Decree 55/2014, which defines the requirements that expense reports must meet to be valid for tax filing purposes.

Here is what a perfect expense report should include:

Personal data

The basic information of the employee who sustained the expenses. They should be clear and accurate to avoid possible misunderstandings or errors. They include:

-

- Full Name: Complete identification of the employee.

- Company Name: The legal name of the business or body for which the employee works. It is fundamental to ensure that the expense report is associated with the proper organization, especially in large companies or groups having several companies.

Expense list

A comprehensive list of expenses is vital to understanding the nature and extent of costs incurred:

- Detailed: Each expense should be described in detail, specifying, for example, whether it is a business dinner, a train ticket, or an overnight stay in a hotel.

- Broken by category: Expenses should be split into categories, such as travel, food, accommodation, etc. This helps to understand the nature of expenses quickly and facilitates their approval and accounting.

Date and place

These details are key to putting expenses in context:

-

- Period: Specifying the dates when the expenses were incurred helps to understand the context and verify their relevance.

- Context: The place or event at which the expenses were sustained (e.g., a business conference in Milan or a client meeting in Rome) provides additional details about the nature of the expenses.

Reimbursement of expenses incurred

This section of the expense report should make it clear how and when the employee will be reimbursed:

- Method of reimbursement: Whether by wire transfer, check or other means, it is key to specify how the employee will receive their reimbursement.

- Refund times: Clearly state when the employee can expect to get reimbursed, for example, within 30 days of submitting the expense report.

Managing expense reports in complex projects

Managing expense reports in a complex project environment can be a significant challenge due to the variety of expenses and the reporting process’s complexity.

Some of the challenges and critical issues that can arise in managing expense reports in complex projects include:

Variety of expenses

In large projects, expenses can come from multiple sources and for different reasons:

-

- Travel and transfers: Business travel, both domestic and international, may include expenses for transportation, accommodation, food, and other related expenses.

- Procurement of goods and services: This may include software purchases, equipment, external consulting, and more.

- Events and trainings: Attending or hosting events, seminars or training courses may incur significant costs.

- Unexpected expenses: In any project, unexpected expenses may emerge during the course of the project and must be properly documented and justified.

Complexity of the reporting process

Reporting expenses in complex projects can be a tricky process:

-

- Expense approval: Any expense might require approval from different hierarchical levels or departments, such as finance or management.

- Verification and monitoring: Expenses must be reviewed to ensure they are legitimate, relevant to the project, and in compliance with company policies.

- Reporting: All expenses must be documented appropriately, with receipts, invoices, and other evidence justifying the amount spent.

- Reimbursement: Once approved, expenses must be reimbursed timely, per the procedures and timeframes established by the company.

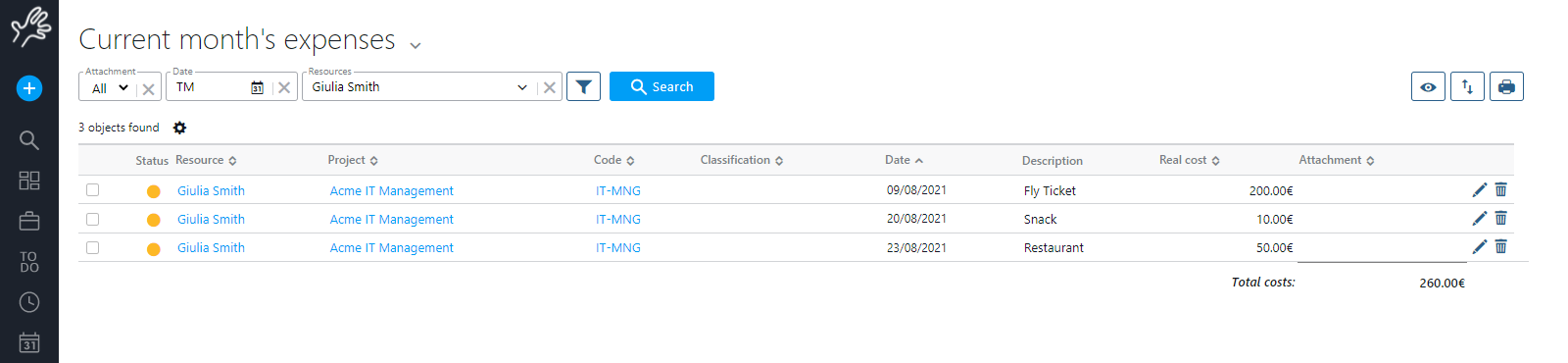

Twproject: a one-stop solution for managing expense reports

In an age where digitization and automation are revolutionizing how businesses work, expense report management is no exception.

Manual expense management, relying on spreadsheets and folders full of receipts, has become obsolete and ineffective, especially in large businesses or complex projects.

Twproject stands out as a state-of-the-art solution, offering many features that make it a precious ally for businesses.

Here is a detailed analysis of its key features:

- Multi-currency management: In an international context, companies must often manage expenses in different currencies. Twproject can manage expense reports in various currencies, ensuring accurate and up-to-date conversions and making reporting and approving costs incurred in foreign currencies easier.

- Recurring and one-time expenses: Every company has recurring payments, such as subscriptions, but also one-time costs, such as travel expenses. Twproject allows both types to be managed effectively, enabling clear categorization and detailed tracking.

- Personal expenses: An employee may incur an expense that does not fall under the company’s reimbursable items. Twproject also offers the option to record these expenses, ensuring a clear distinction between reimbursable and non-reimbursable expenses, thereby providing transparency and clarity in the reporting process.

- Efficiency and accuracy: Managing expense reports with Twproject significantly reduces the time spent filling out, approving, and reimbursing expenses. It also minimizes the risk of human error, ensuring more accurate reporting.

- Allocation to cost center: Whenever an expense report is inserted, it can be automatically associated with a specific cost center. This ensures that each expense is correctly recorded and allocated to the right project or department.

- Accessibility and traceability: Expense information will become accessible in real-time from any device, allowing better tracking of expenses and greater transparency in the process.

Bottom line, Twproject is not just a project management tool but also a comprehensive solution for managing expense reports.

Its versatility and advanced features make it a great option for companies looking for an effective and reliable way to manage expenses.