The analysis of the costs (and benefits) of a project, is crucial in project management and is often the most critical element for a project manager. Let us take a closer look at this essential process.

When managing a project, it is necessary to make many important decisions, such as implementing project monitoring and control during the project life cycle.

TABLE OF CONTENT

Because of the high stakes involved, good project managers do not simply make decisions based on instinct. They prefer to minimize risk and act only when there is more certainty than uncertainty.

But how is this possible in a world with a myriad of variables and a constantly changing economy?

The answer is:

rigorously consult collected data with reporting tools, graphs and spreadsheets.

Project managers can then use this data to evaluate their decisions with a process called cost-benefit analysis of a project.

Smart use of cost-benefit analysis will help minimize risks and maximize profits for both the project and the organization in general.

What is a project cost analysis?

The cost analysis in project management was designed to assess the cost compared to the benefits in the project proposal.

This process begins with a list, which includes all the expenses of the project together with the benefits that will derive from it once the project will be successfully completed.

From this, it is possible to calculate the return on investment (ROI), the internal rate of return (IRR), the net present value (NPV) and the amortization period.

The difference between the cost and the benefits will determine whether the action is worth it or not.

In most cases, if the cost is 50% of the benefits and the amortization period is not more than one year, it is worth taking action.

A cost-benefit analysis is a process that allows organizations to analyze decisions, systems, or processes or determine a value for intangible assets.

The model helps to identify the benefits of an action and the actual costs of it, subtracting the costs from the benefits.

Once completed, a cost-benefit analysis will produce concrete results that we can use to develop reasonable conclusions about the feasibility and / or opportunity that represents a specific decision or situation.

The purpose of the cost-benefit analysis

The purpose of the cost-benefit analysis is to have a systemic approach in order to understand the advantages and disadvantages of various solutions through a project, including transactions, activities, business requirements, and investments.

Cost-benefit analysis offers options and is the best approach to achieve a goal while saving on investment.

There are two main purposes for using a cost-benefit analysis for a project:

- To determine if the project is valid, justifiable and feasible, verifying if its benefits exceed the costs.

- It offers a cost baseline for comparing projects by determining which project benefits are greater than its costs.

The cost-benefit analysis process: 10 key steps

The process of cost-benefit analysis of a project has 10 steps through which we can establish the convenience of the project. Let’s see what they are:

- What are the goals of the project? Before you can decide if a project is worth, you need to have a clear and precise idea of what it must accomplish.

- What are the alternatives? Before you can know if the project is the right one, you need to compare it with other projects and see which is the best one to follow.

- Who are the interested parties? List all project stakeholders.

- What measures will you use? You need to decide the metrics you will use to measure all costs and benefits.

- What is the outcome of costs and benefits? You need to know what the costs and benefits of the project are and map them over a significant period of time.

- What is the common currency? Here, we take all the costs and benefits and convert them into the same currency in order to make a real comparison.

- What discount rate will be applied? This will express the amount of interest as a percentage of the balance at the end of a certain period.

- How is the net present value of the project options? This is a measure of profit that we can calculate by subtracting the current values of the cash outflows from the current values of incoming cash flows over a given period of time.

- Sensitivity analysis? This is a study of how the uncertainty of the output can be divided into different sources of uncertainty in its inputs.

- Final decision? The final step, after collecting all these data, is to make the most recommended choice according to the analysis.

Are there limitations to cost-benefit analysis?

Of course, there is always a risk inherent in any business, and the risk and uncertainty must be considered when evaluating the cost-benefit analysis of a project.

It is possible to calculate this with the probability theory. Uncertainty is different from risk, but can be assessed using a sensitivity analysis in order to illustrate how the results respond to parameter changes.

Overall the use of cost-benefit analysis is a crucial step in determining whether it is worth pursuing any project.

For projects involving small to medium capital expenditures and from short to intermediate (in terms of completion time), a thorough analysis of project costs may be sufficient to make a rational and well-informed decision.

For large projects with a long-term time horizon, cost-benefit analysis typically fails to justify important financial concerns such as inflation, interest rates, variable cash flows, and the present value of money.

Alternative methods of analyzing initial capital, including the net present value or internal rate of return, are more appropriate for these situations.

Unless you are extremely lucky, it will never be possible to get all the information needed to complete a cost-benefit analysis.

There will in fact always be gaps in information.

Cost analysis: the hypothesis method

One way to try to overcome these shortcomings is to use hypotheses about the missing information.

However, for the inexperienced project manager, hypothesis creation is one of the most terrifying aspects of an analysis of project costs.

Here is an example: we are conducting a cost-benefit analysis for a real estate investment project. There may be a case of not knowing what the maintenance costs will be in the future. What we know, however, are the types of maintenance fees that have been paid for similar properties in the past. You can then use some of those numbers to make an assumption.

In any case, we must be careful when using assumptions. Factors do not always follow trends and even the smallest change in the hypothesis can produce totally different results.

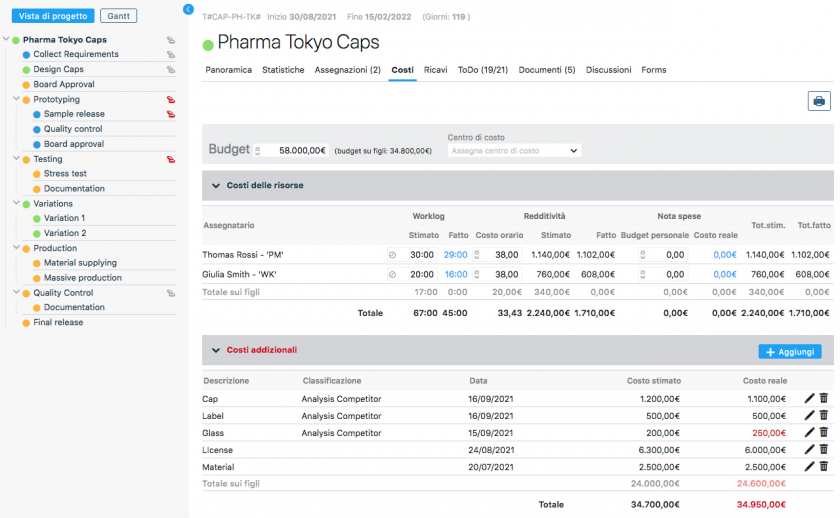

In conclusion, analysis of project costs is a data-driven process and very often requires a sufficiently robust project management software to handle and distribute information.

If you haven’t tried TwProject yet, do it now! You will discover how simple it is to organize information and complete a cost-benefit analysis, thanks to its simple and precise project cost and budget management.