How to prepare a budget? As a business grows and becomes increasingly complex, budget preparation and realistic forecasting become ever more critical.

Budgeting and forecasting may sound the same, but within the corporate financial framework, they present distinctive characteristics.

Although they cover two different spheres, budgets and forecasts work together to produce a comprehensive guide to a project’s and the company’s financial performance.

Understanding the difference between budgeting and forecasting and strategies to manage them best can help an organization operate successfully.

CONTENT

Budget vs forecasts

As previously mentioned, budgets and forecasts are not the same thing.

A budget is a financial plan that outlines an organization’s future earnings and expenditures.

It is the basic blueprint for a company’s financial operations, setting out how much and what it plans to spend.

When set, the budget generally remains as is, becoming the benchmark for financial performance.

Conversely, a forecast predicts an organization’s future financial events based on current business trends, market conditions, and relevant data. The goal is to estimate how internal and external trends will affect a project or company’s financial future.

For example, forecasting may discover an opportunity to enter a new market by launching an innovative product.

Based on the forecast’s findings, a project manager can develop a strategic plan to capitalize on opportunities and overcome challenges. Budgeting is static, whereas forecasting is dynamic and an important part of the overall business plan.

This means that forecasting can be revised frequently, especially when internal changes or important influential external factors come to light.

The role of management control

To successfully implement a coherent budget and forecast, it is crucial to implement sound management control.

This process consists of continuously monitoring set targets and comparing them with actual results to pinpoint any deviations and take appropriate corrective action in a timely manner.

Management relies on the information provided by management control to make strategic decisions and properly allocate financial resources.

How to prepare a budget

Here are five basic steps to follow when drafting a budget:

1. Review and collect input

Inputs refer to all elements, such as fixed and variable expenses, revenue flows, and any other elements that can influence financial planning. At this stage, it is important to differentiate fixed and variable costs to have a clear overview of the operating margins.

2. Analyze historical data

Researching past budgets and other historical financial data provides insight into past trends to help establish realistic business goals for revenue and expenses for each month and fiscal year. You can also take the performance of the industry in which you operate as benchmarks.

3. Get cross-functional stakeholders involved

Consulting and communicating with stakeholders from other departments, such as sales managers or executives, provides insight into how the company’s priorities are perceived and helps create a budget that reflects the needs of the whole organization.

This consultation will also make colleagues feel part of the process, increasing their willingness to accept the budget.

4. Plan capital expenditures

Identifying any necessary capital outlays during the budget period, such as equipment, facilities, and property investments, is also important to ensure you have the resources you need to operate and grow smoothly.

5. Set KPIs

KPIs and any other performance indicators will help monitor budget effectiveness. Particularly, it is vital to include in the analysis not only general costs, but also the revenue forecast and variable cost structure to support objectives.

Economic budget and financial budget

In budgeting, it is worth distinguishing between economic and financial budgets.

- The economic budget focuses on the income statement, namely cost projections (fixed and variable) and revenues, to determine the expected profit or loss.

- The financial budget, in contrast, analyzes cash flows (inflows and outflows), cash management, and funding sources to ensure that the company possesses the financial resources needed to support its day-to-day operations and investment projects.

Having these two types of budgets separate helps management make more focused decisions, weighing both economic sustainability and financial soundness.

How to make realistic forecasts

To produce realistic financial forecasts, here are some key steps:

1. Define areas of interest

The first step involves identifying the key metrics that the forecast needs to cover, such as revenue growth or determined cash flow.

2. Update your forecast with the latest financial data

The latest financial data drawn from business operations will be used as the starting point. By incorporating real-time data, the estimates will truly reflect the state of the business at that specific time, ensuring more accurate forecasts.

Additionally, adopting a collaborative budget planning approach can enhance accuracy by involving different departments in the forecasting process. This cross-functional input ensures that all financial projections consider diverse perspectives, leading to more informed decision-making.

3. Set a forecast time frame

The forecast must encompass a specific time frame, which can be monthly, quarterly, or annually, but the performance tracked must be precisely consistent with the chosen time frame.

4. Identify patterns and trends

By analyzing past performance data, you can look for trends that are likely to recur. Are there consistent patterns in sales, spending, and other critical metrics that can guide projections? Moreover, it is important to note when things change, how, and the causes.

5. Take into consideration the influencing factors

When making forecasts, it is important to factor in any known or unknown elements that could impact your forecast. For example, the launch of new products, economic changes in the market, regulatory changes, etc.

Drafting a budget and making forecasts with Twproject

Preparing an accurate budget and making reliable forecasts are two fundamental activities for the success of any project or organization.

Yet, it is also often one of the most complex tasks a project manager can face.

Many organizations rely exclusively on Microsoft Excel due to its familiarity and low cost, but this can be a big mistake in the long run, as fragmented workbooks and manual input can lead to errors.

In this case, choosing a great project management software becomes crucial, as a well-informed decision will help make financial management more precise and strategic.

Among the numerous software available on the market, Twproject stands out for its user-friendliness and wealth of customizable features.

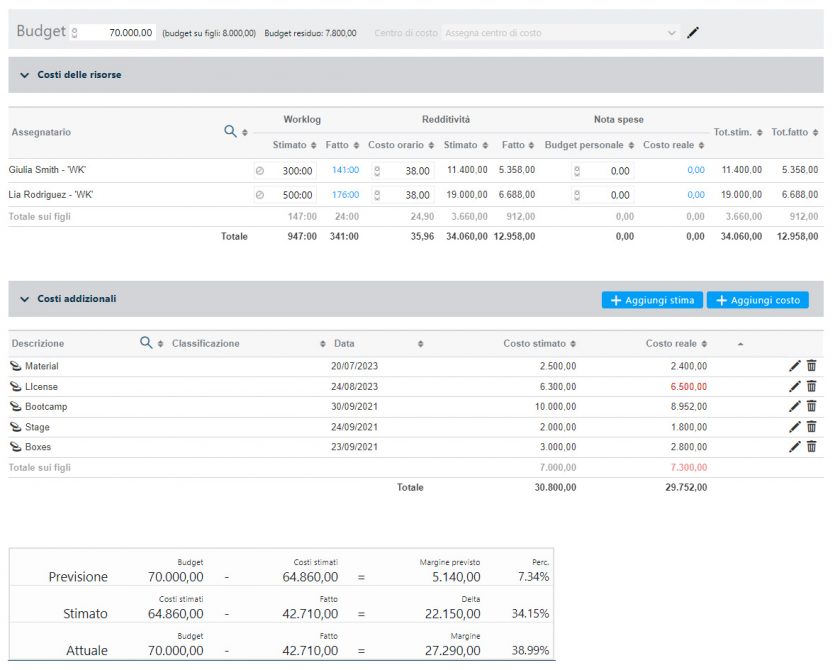

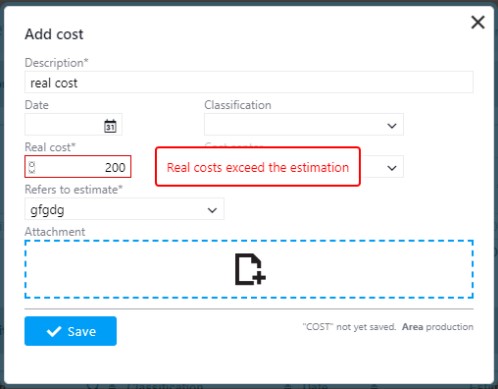

By centralizing all relevant information, such as estimated costs, actual expenses, and available resources, teams, managers, and stakeholders can maintain a clear and up-to-date understanding of the project’s financial situation.

Features such as detailed report generation, scenario simulation, and predictive analysis based on historical data help promptly identify deviations between planned and actual budgets.

Moreover, Twproject provides the potential to predict possible financial risks, optimize resource allocation, and adjust planning as needed.

A further benefit is the streamlined collaboration process between team members and stakeholders, who can easily access relevant financial data and contribute to more informed decisions.

Ultimately, project management software such as Twproject improves operational efficiency and brings crucial support for more informed and success-oriented economic management of a project and the company as a whole.